Federal Tax News for Businesses

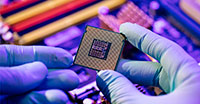

Proposed Tax Credits for Chip Manufacturers

Bipartisan support in Congress for a (limited) tax bill? It’s true! The pared-down CHIPS Act, which would provide tax credits for companies to invest in semiconductor manufacturing, has support from lawmakers in both parties.

The $50 billion bill would provide a 25% tax credit for U.S. businesses that invest in chip-making as well as the specialized tools needed to make chips. The credit, which manufacturers could elect to treat as a payment against tax, is for property placed in service between Dec. 31, 2022, and Jan. 1, 2027. The Senate has voted to forward the CHIPS Act and the House is expected to vote on it before its August recess. Senate Majority Leader Chuck Schumer (D-NY) said he plans to schedule a vote before the August recess with the expectation that the U.S. House of Representatives would follow suit. Click here to read more about the bill.

When Do Businesses Need to Withhold Tax on Certain Payments?

Businesses take note: You may be required to withhold 24% of certain payments to individuals if they don’t provide you with their legal names and taxpayer identification numbers (TINs) — or if the IRS notifies you that a payee’s TIN doesn’t match its records.Types of payments subject to backup withholding include interest, dividends, rents, profits, commissions, gambling winnings and taxable grants, as well as broker, barter exchange and royalty payments. However, backup withholding doesn’t apply to compensation reported on Forms W-2. Click here to read IRS Publication 1281, which contains a comprehensive list of payments subject to backup withholding and more rules.

Cannabis Businesses Face Many Challenges

Marijuana businesses still face federal income tax compliance woes. Though 18 states allow cannabis for recreational use and 37 states allow it for medical use, the National Taxpayer Advocate Erin Collins recently issued a warning for those in the cannabis industry. Businesses that produce, distribute or sell cannabis “should be aware that there are significant federal income tax challenges and understand the federal tax consequences.”The bottom line: Regardless of state law, federal law still considers marijuana a controlled substance and participating in the industry is deemed drug trafficking. Contact your tax advisor with questions, or click here for a list of FAQs from the IRS for marijuana businesses:

Maintain Meticulous Records to Protect Your Deductions

A lack of substantiation caused one taxpayer (and his wife’s estate) to have deductions denied by the IRS — and the U.S. Tax Court agreed with the denials. Here are two issues in the case:

1. Deductions for hiring children. Taxpayers can hire their children to work in their businesses but the children must hold legitimate jobs. In the case, a consultant and his wife’s estate weren’t entitled to business deductions for payments to “assistants,” who were the couple’s children and a grandchild. The payments were for alleged reimbursement or compensation for services provided in connection with consulting activities. Notably, there was no documentary evidence substantiating certain payments. Copies of negotiated checks to the “assistants” from an account used for personal purposes had no notation as to the purpose of payment and there was no evidence to show one child did any work for her father.

2. Business mileage deductions. Taxpayers who use their vehicles for business can deduct some of the costs. But you could lose that tax benefit if you neglect to keep good records as you go. In this case, the consultant and his wife’s estate were denied a business mileage deduction for his consulting activities. He provided mileage logs and calendars showing purported dates of business use of a vehicle. But the records weren’t kept contemporaneously and lacked sufficient detail. Records need to include trip dates and destination, the number of days spent on business and the business purpose of each trip. (TC Memo 2022-70)

Employers Charged the Trust Fund Recovery Penalty in 2 Cases

Employers that withhold taxes from employees but don’t pay them over to the IRS may face harsh penalties, as illustrated in two recent cases.

The Trust Fund Recovery Penalty (TFRP) equals 100% of the unpaid tax. The TFRP can be assessed personally against responsible parties (even non-owners) and may include prison time.Case #1. A taxpayer who operated an ammunition manufacturing and sales business withheld federal taxes from his employees’ paychecks. A U.S. Department of Justice (DOJ) investigation showed that from 2013 to 2016 he failed to pay over withheld taxes of roughly $356,280. The taxpayer was charged a TFRP of $356,280 and was sentenced to 18 months in prison. Click here for the DOJ press release about the case.

Case #2. When the treasurer of an airline-related business was hit with the TFRP on the company’s unpaid taxes, he asked the U.S. Court of Federal Claims to intervene. He stated he was a “cash manager,” without authority to decide which bills to pay, including tax payments. After finding he “had authority to make payments up to $10,000,” to recommend payments, write checks and pay taxes, the court allowed the case to proceed. (Rosenheim, 5/3/22)